Why Profitable Businesses Still Go Broke – and How to Stop It

Is it possible to be profitable… and broke at the same time?

Absolutely.

It’s one of those moments where business owners look at me across the table and say:

“Shane, I don’t get it. Sales are flying in. My accountant says we’re profitable. But I can’t see how we’ll make next week’s payroll. Where’s all the money gone?”

And I have to smile (kindly, of course) because I’ve heard this story so many times.

If you’ve ever been in this position, you’re not alone. It’s surprisingly common — and the cause is often misunderstood.

Yes, sometimes the problem is razor-thin margins. But more often than not, the real culprit is cash flow — and more specifically, the cash gap.

Why “Profit” Doesn’t Always Mean “Cash”

There’s a well-known saying in business:

Revenue is vanity, profit is sanity, and cash is king.

And it’s true.

Your profit and loss statement (P&L) shows an operational truth — how much you’ve sold, what it cost you, and what’s left over as profit. But here’s the catch: a P&L assumes that all those sales are already cash in your hand.

In reality, your business doesn’t run on “theoretical” money. It runs on actual cash in the bank.

That’s where the cash gap comes in.

The Cash Gap Explained

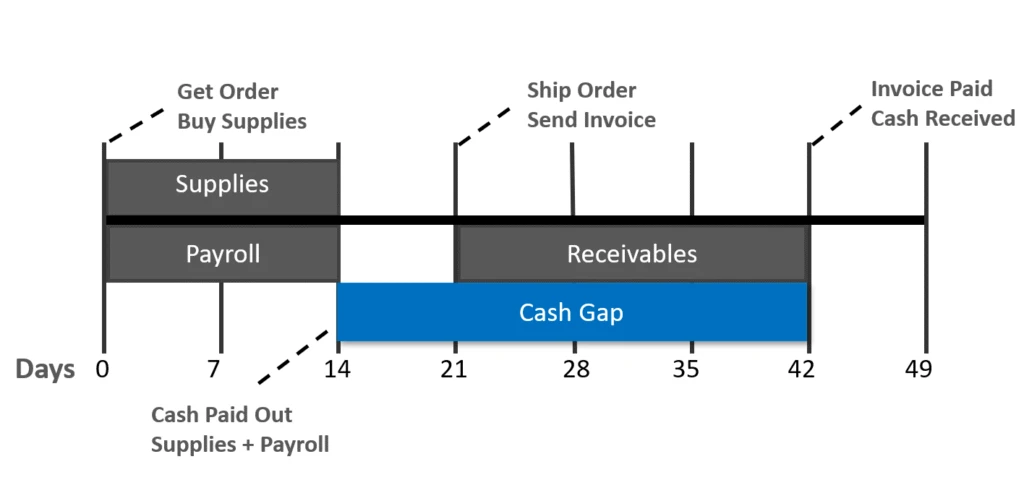

A cash gap happens when you have to pay out money (to suppliers, staff, rent, utilities) before your customers actually pay you.

On paper, your P&L looks fantastic because those unpaid invoices sit there under accounts receivable. But the problem is — you can’t use them to pay the bills until they’re paid.

Here’s an example:

Let’s say you’re a contractor.

- Day 0 – You start a kitchen installation.

- You order parts and pay for some of them upfront.

- Your team starts work, so payroll kicks in.

- You make another payment to your supplier.

Meanwhile, your customer hasn’t paid you yet — maybe they’ve got 30 days to settle the invoice… or maybe they’re just dragging their feet.

That gap between money going out and money coming in is where businesses get into trouble. If you can’t bridge it, you feel broke — even if your P&L says you’re winning.

And if your customers are late payers or your accounts receivable process is weak, that gap widens and becomes a genuine threat to your survival.

How to Reduce the Cash Gap and Keep the Lights On

Here are some practical, small-business-friendly strategies that can make a big difference:

1. Get Paid Faster

- Send invoices as soon as the job is completed.

- Use email and automated reminders to follow up — don’t wait until the end of the month to chase.

- Make it easy for customers to pay you (online payments, card payments, direct debit).

- If you feel awkward about chasing payments, remember: the longer you wait, the less likely you are to get paid in full.

2. Keep Your Records Up to Date

If you’re making decisions on old or incomplete numbers, you’re flying blind. Keep your bookkeeping up to date. If you don’t have the time (or desire), hire a bookkeeper — it’s money well spent.

3. Forecast Your Cash Flow

Do a rolling 13-week cash flow forecast. It’s one of the simplest, most powerful tools to avoid nasty surprises. You’ll see cash crunches before they happen — and you can plan for them.

4. Don’t Manage by Your Bank Balance

A healthy-looking bank account can be deceptive. That money might already be spoken for — payroll, tax bills, supplier invoices. Always know your true available cash before committing to big purchases.

5. Arrange a Safety Net

A business overdraft, a revolving credit facility or an alternative lending facility can help bridge short-term gaps. But treat it like an emergency tool, not a daily habit. Too many owners max out their facility and end up back in the same mess, just with more debt.

The Hidden Twist: Cash Flow Problems Often Come With Growth

Here’s the ironic part: cash flow crises often hit when your business is booming.

Why? Because every new order or contract needs materials, labour, and overhead before it brings in revenue. If you’re growing quickly, your need for working capital shoots up — and if you’re not prepared, it can choke your growth.

That’s why good financial systems, disciplined invoicing, and strong cash flow forecasting aren’t just “nice to have” — they’re survival tools.

Final Word

If you’ve been feeling the pressure of cash gaps, remember:

- It’s not always a sign your business is failing.

- It’s a sign you need to manage timing and flow, not just sales and profit.

The fix isn’t glamorous, but it’s effective — better systems, better discipline, and better planning.

And if you need a sounding board or a fresh set of eyes on your numbers, I help business owners untangle this exact problem all the time.

Book a free 15-minute call with me here and let’s talk about how to make your cash work as hard as you do.